Income Fund Investments

SolPacific currently has two fixed-income, high-yield investment fund opportunities. Capital invested in the funds is primarily offered as mezzanine loans to real estate holding companies specializing in developing affordable and market-rate multifamily housing in the Midwest and Western United States. Both funds have an associated Revolving Loan investment option.

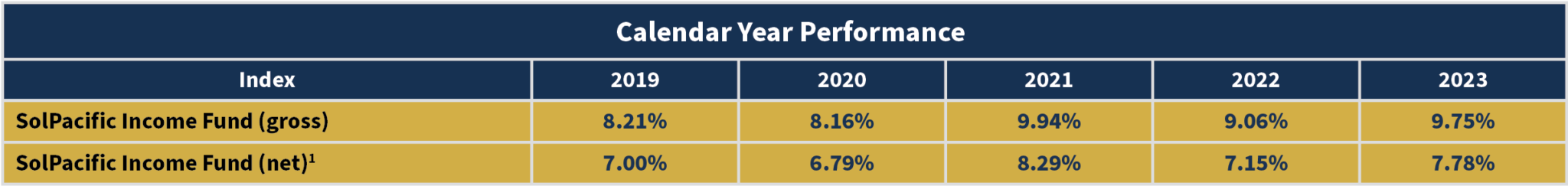

SolPacific Income Fund (SPIF)

Since its inception in 2015, SPIF has achieved annualized net returns of 7-9% to investors, as outlined below. Investors can choose to receive quarterly distributions or quarterly reinvestments of earnings to their investor capital accounts.

SPIF is for investors looking to achieve a stable, risk-adjusted return and desire a consistent cash flow. SPIF is limited to qualified Investors with a minimum investment amount of $300,000.

- 5-year Average Annualized Net Returns to investors: 7.40%

- No management fees. Manager profit participation is earned only after investor’s return exceeds 4.00% annually

- Distributions paid quarterly or reinvested per investor election

- Investment can be redeemed after one year, subject to withdrawal provisions

- SPIF assets under management are approximately $135 million

- Minimum investment: $300,000

1Represents net return to Investors afters Manager's profit participation and Fund expenses

Property Examples

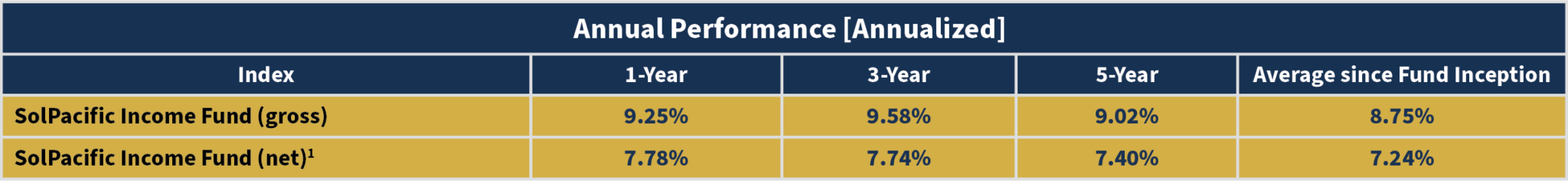

SolPacific Deferred Income Fund (DIF)

Since its inception in 2021, DIF has achieved annualized net returns of 7-9% to investors, as outlined below. Earnings are reinvested quarterly into investor capital accounts.

DIF is for investors looking to achieve a stable, risk-adjusted return and do not require consistent cash flow. DIF is limited to qualified investors with a minimum investment amount of $500,000.

- Average Annualized Net Returns to investors since inception: 8.26%

- No management fees. Manager profit participation is earned only after investor’s return exceeds 4.00% annually

- Earnings are reinvested quarterly

- Investment can be redeemed after two years subject to withdrawal provisions

- DIF assets under management are approximately $40 million

- Minimum investment: $500,000

1Represents net return to Investors afters Manager's profit participation and Fund expenses

2Represents inception through year end 12/31/2023

Property Examples

Revolving Loan Program

Investors in the SolPacific Income Fund and the Deferred Income Fund can invest additional capital into a revolving loan program. This investment offers a fixed annualized rate of interest based on current market conditions with no investment holding period.

- Minimum investment: $50,000

- Interest paid quarterly or reinvested per investor election

- No fees to participate

- No holding period. Liquid within three (3) business days of notice

- Liquidity provided by a national bank line of credit